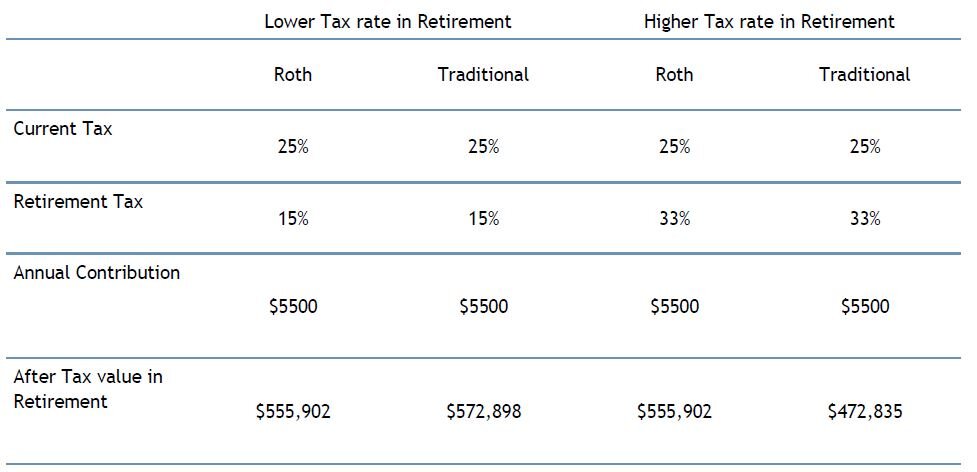

Now there are some other considerations to make when making this decision, because it is not as simple as it seems. The reality of the situation is that it is very hard to predict where your income will be in the next 10, 20, maybe 30 years from now. So it is hard to tell whether you'd be better off going with the Roth or traditional IRA. There is also the argument that it never hurts to have some control on your different cash flows. By securing a Roth IRA, you are ensuring that in the future you will be able to access money tax free.

Roth IRAs will allow you to grow your money tax free, forever. I use the word forever because unlike traditional IRAs, Roths do not require you to take required minimum distributions (RMDs) during your lifetime. In fact, Roth IRAs are the only tax sheltered retirement plan that does not require RMDs. Another differentiator for the Roth IRA is that it allows you to leave the IRA as a bequest to your heirs, tax free. Now in this case your heirs would have to take RMDs, but they still will not have to pay any federal income tax.

A discussion of Roth IRAs would not be complete without a mention of a Roth feature within a 401(K). For the majority of our clients who are over the IRA income limits this is a great solution. By electing a Roth feature within a 401(k) plan you can enjoy the benefits of a Roth IRA, gathering your after tax contributions into a Roth account. It is important to note that only the employee salary deferral contribution is eligible to be allocated into the Roth portion of the account. The matching contributions from the employer must always be done in the traditional pre tax format.

Once we decide which is right for you, how is it going to be funded? Both the Roth and the traditional IRA will be funded through contributions from your earned income, that is sort of the entire point. What if I already have an old 401k account? Good news, 401K accounts are eligible to be rolled into a Roth or traditional IRA. And if you have a Traditional IRA, you can roll that into a Roth IRA as well.

You have decided that all or some of your IRA should be converted to a Roth IRA, what else do you need to know? There are three ways to accomplish a Roth Conversion. The first being a 60—day rollover. In this method you will take a direct delivery of your funds out of your traditional IRA at which point you have 60 days to roll them into your new Roth IRA. Failing to do so within 60 days will result in a 10% early distribution tax, and the distribution will be taxable in the year received. The next option would be a trustee to trustee transfer. This method is one of the “safest” as it essentially guarantees the chance that your funds would end up taxable. This method simply consists of having your IRA trustee to direct the funds to the trustee of your new Roth IRA.