“Don’t let the Tax Tail wag the Investment Dog”

/Ok wait what..? I know I know allow me to explain what I mean by this ridiculous sounding sentence.

“Don’t let the tax tail wag the investment dog” is a phrase I heard repeated across our trading floor from one of our Senior Partners during my first years in portfolio management. I was understandably confused by this insane sentence, but I did not want to be “that guy” and ask. What I went on to learn was that he meant that we could not allow tax consequences to dictate our portfolio management strategy. Managing a portfolio in a tax efficient matter was critical, however there would be moments when a portfolio would need to be rebalanced and that that sale would trigger capital gains taxes. In essence he acknowledged that paying taxes was of course never fun, but that we could not allow that to intrude into our portfolio management.

Taxes are an unfortunate but necessary consequence, or result, of financial gain. They are largely unavoidable and yes, it is never enjoyable to get out the check book out for Uncle Sam. However they an integral part of investing.

This becomes an issue when a portfolio has greatly appreciated over time. It’s ironic that is an “issue” considering that capital appreciation is basically one of the primary goals of investing. The problem occurs when one holds an asset for too long simply because they want to avoid paying the taxes on it. It is very important to avoid the trap. Before we can understand why it is so important, we must be aware of how these assets are actually taxed.

When considering taxation on an investment account you must separate the components into capital appreciation and investment income. For taxable accounts, investors will pay taxes on their investment income in the year in which they received it. Particularly, this refers to dividends and interest generated by an investment portfolio. The tax on the income generated by a portfolio will be taxed at the investor’s marginal income tax bracket. Qualified dividends will be taxed at the lower long term capital gains rate.

Capital appreciation (when equity investments go up in value) is taxed at your capital gains tax rate. Capital gains tax is then further differentiated between what is short term and long term. If an asset is bought and sold within 1 year it will be subject to short term capital gains. Generally speaking this will be the investors marginal income tax bracket. Investments that are sold after being held for more than 1 year will be subject to long term capital gains. This is a preferential tax treatment as it will be lower than your marginal income tax bracket.

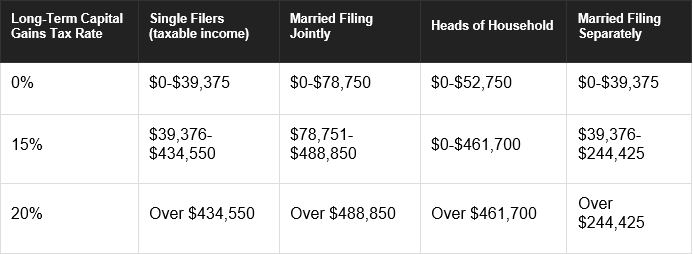

The capital gains tax rate will either be 0%, 15%, or 20% depending on your income.

Source: Tax Foundation

Now that we have a grasp on how these investment assets are taxed, here is why it is so important not to allow this to get in the way of your investment strategy. Rebalancing a portfolio is a critical part of any investment strategy. Rebalancing goes hand in hand with asset allocation, or the mix of stocks and bonds within a portfolio. Over time, certain asset classes will increase in value vs others. When this happens, your portfolio becomes, to say it technically, “out of whack.” Meaning the mix between your stocks and bonds does not match up with the original asset allocation your advisor had chosen when you began investing. Consider the following example:

During a bull market similar to the one we have enjoyed over the last 10 years, the equity portion of your portfolio will begin to outweigh the fixed income portion of your portfolio. What might have started as a 60 / 40 mix might over time start to look like something closer to a 80 / 20. This is a good thing. This means the investments in your portfolio have appreciated as you wanted them to. In order to return the portfolio back to its strategic asset allocation you will have to sell down certain parts of the portfolio (decrease) in order to buy back other asset classes (increase). Of course in this scenario, selling down certain parts of the portfolio means selling appreciated assets which, you guessed it - means paying some capital gains taxes on that amount. Paying taxes is the price you pay participate in the equity markets and, even more specifically, the price you pay to keep a strategic asset allocation over time.

There may be the temptation to hold onto an appreciated asset simply in order to avoid paying taxes on it. In the moment it can sometimes be easier to justify holding onto a position and keeping an equity overweight “for now” and skip paying the taxes. This can become an issue for 2 reasons:

Not rebalancing the portfolio could reduce returns over time

You will end up holding a portfolio with an asset allocation that does not reflect your risk tolerance

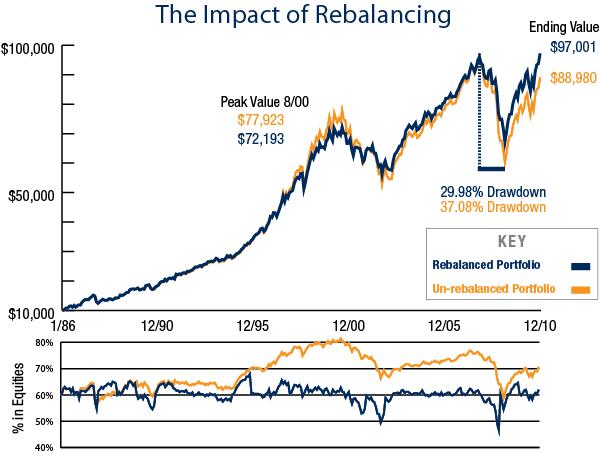

For a long term asset allocation based investor, rebalancing is an integral part of the management of the portfolio. Making sure the portfolio is being “snapped back to grid” over different market cycles is critical. Consider the following chart which shows 2 portfolios that began with the same exact investment strategy. One portfolio was properly rebalanced periodically and the other portfolio was left untended.

These portfolios both began as a 60 / 40 mix between stocks and bonds, with an initial investment of $10,000. The blue line’s portfolio was rebalanced annually back to the 60 / 40 asset allocation. The yellow line, as referenced above, was never rebalanced over the 25 year period. Two main observations come out of this chart. First, the rebalanced portfolio had a greater return than the un-rebalanced. Secondly and perhaps more importantly, the rebalanced portfolio has a much lower drawdown exposure during bear markets.

Consider the period leading up to 2008. You could have owned a 60 / 40 portfolio from 2004 up to 2008. Hypothetically speaking, considering the appreciation in the equity markets leading up to the great recession if you had not rebalanced then you would’ve owned a portfolio looking something similar to 80 / 20 just as the US entered into one of the harshest drop in equities. Essentially you would have owned much more stocks within your portfolio right when stocks ended up dropping drastically.

Rebalancing the portfolio, snapping it back to grid, is an essential part of long term investing. Rebalancing may at times mean selling down appreciated assets, and triggering a capital gains tax liability. This is just a fundamental element with investing. It is important to talk to your advisor about your feelings in regards to paying capital gains tax. Talking to your advisor in order to establish proper tax expectations is important. The last thing you would want is to be faced with an unexpected tax bill that was triggered by capital gains. It is also important to coordinate these decisions with your tax professional. Paying taxes is never fun, however over time it is the lesser evil considering the unintended consequences that can occur from a well structured portfolio that is not properly maintained.

PS: There are other some factors that come into play when considering taxable gains within a portfolio. These would include tax loss carry forward considerations and tax loss harvesting strategies. Stay tuned for future posts drilling down into these topics.